How to File a 1099 Return for US Companies: A Step-by-Step Guide

Filing 1099 returns is an important compliance task for US businesses that work with independent contractors or vendors. If your company pays non-employees for services, understanding the 1099 process will help you avoid penalties and keep your accounting clean. Here’s everything you need to know about filing a 1099 return, including eligibility, deadlines, and a practical example.

Who Needs to File a 1099?

Businesses—including LLCs, corporations, partnerships, and sole proprietors—must file a 1099-NEC if they paid $600 or more to a non-employee for services during the year. Common recipients include freelance professionals, consultants, and vendors.

You must file a 1099-NEC if: – You paid $600 or more for services (not goods or products) – The recipient is not your employee – The recipient is an individual, partnership, or LLC (excluding most corporations, except attorneys)

Exceptions: – Payments to most corporations (except attorneys) – Payments for physical goods, utilities, and some rents (rents may require 1099-MISC)

Important Deadlines

- January 31: Send 1099-NEC forms to contractors and file with the IRS

- February 28: Mail paper 1099-MISC forms to the IRS (if applicable)

- March 31: File electronic 1099-MISC forms with the IRS

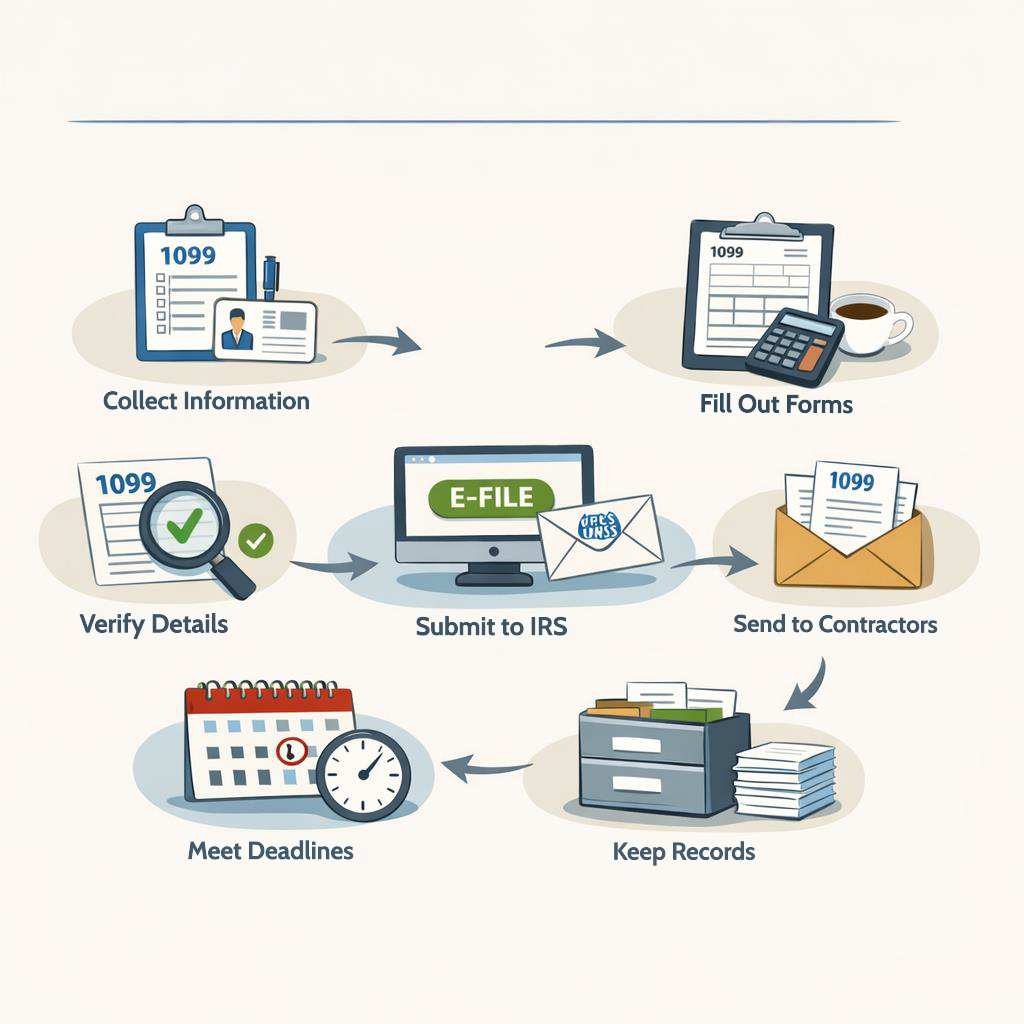

How to File a 1099 Return

- Collect W-9 Forms: Before paying a contractor, ask for a completed W-9 form. This provides the information needed for the 1099.

- Track Payments: Maintain clear records of all payments to non-employees.

- Prepare the 1099: Use the information from the W-9 to fill out the 1099-NEC. Include your business details, the recipient’s info, and the total paid.

- Distribute Copies: Send Copy B to the contractor by January 31.

- File with the IRS: Submit Copy A to the IRS by the deadline, either by mail or electronically via the IRS FIRE system.

- Check State Requirements: Some states require separate 1099 filings. Confirm with your state’s tax authority.

Example: Filing a 1099-NEC

Imagine your business, Remote Books Inc., hires a freelance web developer and pays them $2,000 in a year. You: – Collect a W-9 from the developer – Track the total paid – Prepare a 1099-NEC showing $2,000 paid – Send the form to the developer and file it with the IRS by January 31

Penalties for Missing the Deadline

Late filings can result in penalties ranging from $60 to $310 per form, depending on how late the submission is. Intentional disregard of the requirement can lead to much higher fines.

Pro Tips

- Use accounting software to automate 1099 filings

- Double-check all recipient info for accuracy

- Keep copies of all filed forms and payment records

Staying on top of 1099 filing helps keep your business compliant and strengthens relationships with your contractors. If you need support with filing or want expert guidance tailored to your business, click the button below to book a consultation with us.

#1099Filing #TaxCompliance #USBusinesses #IRSDeadline #AccountingTips #SmallBusinessSupport #January31 #RemoteBooksInc #ContractorPayments #TaxSeason2026